Cash is King: Why Business Owners Turn to Life Insurance

December 11, 2024Most business owners understand the necessity of life insurance to protect the viability of their business should they die – whether it’s for income replacement, buying out the business from other partners, paying off debt, or infusing capital to keep the business going during the transition period after death. However, most business owners do not fully appreciate the value of life insurance or the role it can play in their business while they’re still alive.

Increase your ability to access capital

Money makes the world go round. At least access to it does. Access to cash is the lifeblood of every business. It’s so important that a recent Goldman Sachs survey found that 77% of small business owners are worried about their ability to access the capital needed to run and grow their businesses[1].

This is why permanent life insurance is an attractive asset to have on your balance sheet, as a strong balance sheet increases your ability to access capital. Besides strengthening the balance sheet, a policy’s Cash Surrender Value (CSV) can be leveraged at favourable rates, providing a source of liquidity for various reasons, such as business expenses or investment opportunities.

3 Reasons why life insurance is a preferred asset on your balance sheet

Not only is life insurance an asset, we view it as a preferred asset because there is nothing quite like it. Here are three reasons why.

- The assets within the CSV of a life insurance policy are some of the safest and most diversified on the market. They’re invested over a long period of time and, therefore, have a smoothing mechanism to protect policyholders from temporary volatile markets.

- The growth of these assets within your policy is tax-deferred. This means the policy’s dividends and capital gains income accumulate and compound every year within the policy. Also, since the investments are within the policy, investment returns do not count towards the Adjusted Aggregate Investment Income (AAII) calculation that must be completed each year to determine how much active business income qualifies for the Small Business tax rate.

- Over time, the CSV of the policy (asset) exceeds the premiums paid (expense), resulting in a net increase in value on financial statements.

Combined, these attributes allow life insurance to have some of the most attractive risk-adjusted returns on capital.

Here’s how it actually works

In a whitepaper written for CPAs in Canada[2], Sun Life presented a case study and illustrated the effect of permanent life insurance on a company’s balance sheet. This illustration demonstrates how permanent life insurance impacts a company’s financial position over the long term.

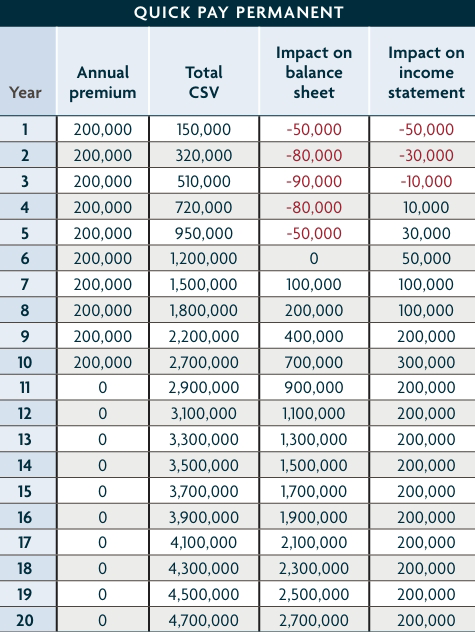

The following is a Sun Life representation of a business’s balance sheet while owning corporate-owned life insurance over a 20-year period and assuming a Quick Pay Permanent Policy and a $200,000 premium over the first 10 years.

In this model, a total of $2 million of premiums are paid into the policy over 10 years, with a cash value of $2.7 million. After a further 10 years, without any further spending in premiums, the cash value of the policy will be $4.7 million. This creates a $2.7 million net positive outcome on your balance sheet after owning the policy for 20 years.

Leveraging the policy as a standalone asset

In addition to the increase in value that the insurance policy can contribute to the balance sheet, the CSV can be directly leveraged as a standalone asset. There’s the old saying, “Banks only lend to you when you don’t need the money.” If leveraging at a company level is not possible, life insurance policies can be leveraged directly.

Policies from the major Canadian life insurance companies may be leveraged at 90-100% of the CSV and at rates that are often more competitive than other assets — including real estate.

Leveraging your own policy to address cash flow needs allows business owners to tap into a strategy that’s often called “being your own bank.”

Many successful people have used their insurance policies for capital

When Walt Disney set out to build Disneyland, he was famously denied a business loan by the banks[3]. But Disney had a vision that no one else saw. Where he saw opportunity, the banks saw extreme risk. So, he funded his dream using his whole life insurance policy. Today, Disneyland’s sister park, Disney World, has generated a staggering $40 billion in total economic impact in fiscal year 2022 alone. This includes the direct contribution of 263,000 jobs in Florida, which is 1 out of every 32 jobs in the state[4].

Disney was one of many entrepreneurs who did so. James Cash Penney Jr., the founder of JCPenney, used his life insurance policy during the great financial crisis in 1929 to fund his payroll[5]. Ray Kroc, the businessman behind the global expansion of McDonald’s, also used life insurance to fund essential expenses at a time no one else would[6].

Whether it’s for a vision nobody else sees or timely expenses that need to be paid, life insurance can provide you with access to the required capital.

It’s harder to access capital in Canada

The fact is that accessing cost-effective capital is an ongoing challenge for business owners, especially in Canada. Fewer than 2% of Canadian medium-sized businesses grow into large firms annually[7]. This helps explain why small and medium-sized businesses employ 90% of Canadians, while that number is only 47% in the United States[8].

This challenge is echoed by the Canadian Venture Capital and Private Equity Association (CVCA). In a survey of venture capitalists, private equity, and “other” investors, 82% of respondents stated that their biggest concern was their portfolio companies securing financing and liquidity in the upcoming year[9].

Focus on what matters

As a business grows and evolves, having a reliable source of capital becomes increasingly valuable — not just for peace of mind but to act on opportunities when they arise — and corporate-owned life insurance will help cover bumps in cash flow.

With more than $13 billion in life insurance managed, we are the largest and most sophisticated life insurance brokerage in Canada, committed to helping business owners build stronger, more resilient companies through strategic insurance solutions.