Life Insurance as an Asset Class

January 16, 2023The use of life Insurance has been traced as far back as the ancient roman empire, where poor Roman families would have to pay for their loved one’s final expenses or risk them being disposed of in a common garbage landfill1. Because most poor Romans could not afford to pay for their final expenses, they would join burial clubs while they were alive, where the club would pool the members’ funds and pay them out upon each member’s death. The dynamics of the contract between a burial club and their members was even like a modern-day contract between the “Insurer” and the “Policy Holder”. Upon joining the burial club, each member would pay a large fee to enter (which sometimes included wine), and then a much smaller one every month until their death. Though the concept is similar, Life Insurance has changed a lot since 2,000 years ago, more specifically, we don’t accept wine for premiums any more, and an insurance policy is used more than just its death benefit.

Today, insurance and our financial system is more efficient, and people’s personal financials more integrated and complicated than they were back then. Many of our clients’ financial setup and insurance are intertwined to maximize each client’s benefit, whether its paying for estate tax or to safely maximize return on investment. Its Life Insurance’s versatility and cash value aspect is why we view life Insurance as an asset class.

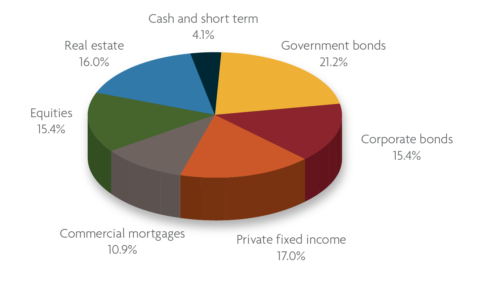

Every life insurance premium payment goes towards two parts of the contract, the first is toward the mortality portion which pays a lumpsum benefit upon death, the second goes towards cash value, which is a portfolio of diverse investments that grows over time. And its that diversity and stability that separates Life Insurance, specifically Participating (PAR) Whole Life Insurance and Universal Life Insurance, as an asset in the portfolio of the average high-net-worth individual. See below, this is the average high-net-worth portfolio.

Compare that to the average portfolio within a Participating Whole Life Policy2. A Whole Life Policy’s portfolio makes a prudent addition to a single asset intense portfolio.

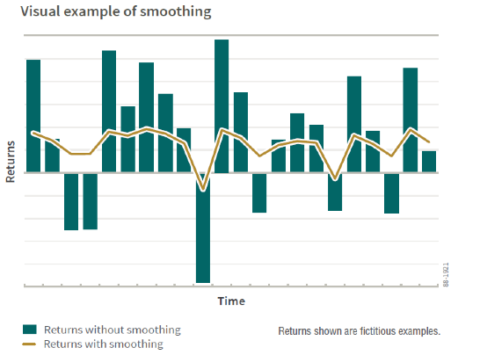

In addition to the diverse portfolio makeup, these investments were seeded as far back as 20 years ago3, and added to every year since. This long-term investment horizon creates a smoothing mechanism that protects each investor from the volatility of the everyday markets yet leaves them some exposure to the market’s overall upward trend. To highlight the stability of a diverse portfolio makeup, see how the return on a smoothed PAR Whole Life Policy compares to the returns of the same assets on a current basis.

Even comparing a PAR policy’s portfolio asset makeup to other fixed investment vehicles like bonds, liquidity is better because there are no market adjustments; and there’s less volatility because of the portfolio’s smoothing mechanism. This smoothing mechanism helps to keep the dividend scale interest rate more stable over time, allowing the investor to take advantage of good timing. Finally, PAR offers greater estate benefits because of the tax efficiency of life insurance.

We compare using insurance as an asset as similar to buying real estate. You will need to commit to a long-term steady monthly mortgage premium that will help pay the mortgage and build on the existing equity, or “cash value” in insurance’s case. As your equity grows, it can be used as a Home Equity Line of Credit, except in the case of insurance, you do not need to apply for a line of credit. Additionally, you pay no origination fees on the loan, and the interest is paid back to your policy, not to the bank. This is advantageous if there is another investment opportunity you would like to pursue and needed to raise a sum of cash equal or less than the cash value of your policy.

If you’re an individual with a concentrated investment portfolio, adding the diverse set of assets of a PAR policy might be the most prudent course of action. The diverse set of assets, the smoothing mechanism of decades of investment, and the tax deferral of the returns on these investments makes the cash value of insurance the highest return/risk ratio out of any asset class. Have any questions about insurance as an asset class? We have just the industry leading experts to answer them. Please reach out to us. Maybe even send us a bottle of wine too.

____________________________________________________________________________________________

Sources:

- Bernett, R. (2020, May 31). Burial practices in Ancient Rome. Wondrium Daily. Retrieved January 2, 2023, from https://www.wondriumdaily.com/burial-practices-in-ancient-rome/

- Miller, Wayne, et al. “Life Insurance as an Asset Class – Sun Life Financial.” Life Insurance as an Asset Class, Mar. 2017, https://www.sunnet.sunlife.com/files/advisor/english/PDF/810-4764.pdf.

- Ruß, Jochen, and Stefan Schelling. “Return Smoothing in Life Insurance from a Client Perspective.” Insurance: Mathematics and Economics, North-Holland, 27 Nov. 2021, https://www.sciencedirect.com/science/article/pii/S0167668721000457.