How should short-term interest rate increases be viewed?

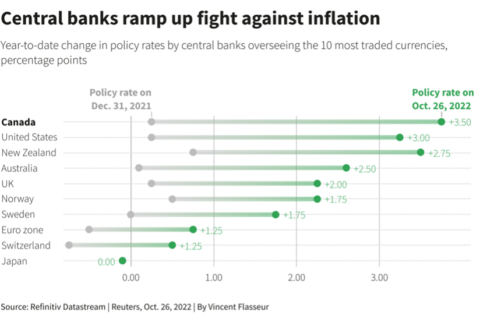

November 21, 2022Since March of 2022, the Bank of Canada has raised its policy rate by 350 points to 3.75%, one of the fastest rate hikes in the country’s history. So much in fact, that as of October 26th, the Bank of Canada has surpassed the policy rate of countries with comparable currencies such as New Zealand (3.5%), Australia (2.75%), the UK (2.25%), and even our southern neighbors, the USA (3.25%).

This begs the question, given the rapid rise in interest rates in most major economies, should I be focused on short-term rate increases? The answer is No, especially in the context of long-term cycles.

The problem is, we’re a short-term wired species, often focussed on the here and now. 10,000 years ago, this served us well. Understanding and reacting to the immediate danger of our predators is why we, as a species, still exist today.

With that said, our every-day environment has outpaced the evolution of our brains, and the immediacy of which we acted 10,000 years ago doesn’t always serve us as well as it did back then, especially the modern-day investor. Our reactionary brain is a large reason why the average individual investor loses at least a portion of their money they invest only after a year of investing[i]. People are prone to make short-term decisions based on recent macro and micro economic events[ii].

So, what does this have to do with interest rates? Well, if we zoom out over the past 30 years of interest rate levels and take a more balanced and holistic view of our environment, we can see that we’ve had rates well higher and well lower than they are now, and there have been many investment vehicles that have performed well over this period.

One such investment vehicle that has performed well and will continue to do so in a rising interest rate environment is insurance. Here are a couple of attractive attributes of insurance in a rising interest rate environment.

Future upside within participating fund. Owners of participating whole life policies will see their dividends increase over time. Since we have been in a general downtrend in rates over the past few decades, insurance companies were forced to reduce policy dividends it paid to their participating whole life policyholders to reflect the market conditions. Now that interest rates are rising, this process will work in reverse.

Insurance as a smoothing mechanism = higher returns at lower risk. If a policyholder holds their life insurance policy the course of their life, they will experience multiple cycles of both rising and falling interest rates, as seen in the chart above. And beyond the death benefit, one thing that remains certain with a policy holder’s policy is that its cash value will consistently grow over time. This is because insurance companies use a smoothing mechanism that purposefully lags the impact of changing interest rates to lower the impact of volatility. This smoothing mechanism paired with the tax advantages of a cash value of an insurance policy deliver some of the highest returns at lower levels of risk.

The Cash Surrender Value (CSV) of a PAR policy can be efficiently leveraged if managed with long-term view

In addition to the CSV of policies from most Canadian insurance companies being viewed as a high-quality leverageable asset, the rate at which the CSV grows within the policy should, over time, outpace and eventually surpass the cumulative premium financing costs. Historically, the DSIR (policy dividend rate) has averaged approximately 3% above achievable borrowing rates. Thus, leverage can make sense – especially if you have higher yielding investment opportunities for the cash that leveraging frees. It is important to note that this is the average case and occurs over time.

Over the long duration of a life insurance product, there will be periods like the one we are currently experiencing, where the borrowing costs are rising much faster than the DSIR. It is even possible that the DSIR and borrowing costs could temporarily invert. In cases like this, there can be short-term pain if one is leveraging their policy. This is only the case if looking at the situation in isolation. Leveraging premium payments can free up capital to use in other higher yielding investments and, when there is high uncertainty, high volatility, and limited safe harbours for capital looking for return, depositing money in an insurance policy, or paying down insurance financing arrangements may be an attractive use of capital.

Conclusion

So even in a higher interest rate environment, with the right investment vehicle that reflects the long-term cycles of interest rates, return on investments will stay consistent over time, no matter when you start. Given insurance’s unique ability to be tax sheltered, leveraged, and grow as an asset, we at The Targeted Strategies Group believe that insurance should be considered as part of every person’s financial plan. Don’t let the noise of the markets stray you from your long-term financial goals.

About TTSG

For more than 20 years, The Targeted Strategies Group of companies has helped successful entrepreneurs and families protect, preserve, and optimize net worth using proprietary life insurance solutions.

_______________________________________________________________________________________________

Sources

- Cadman, Josh. “CFD Trading Statistics.” Finder UK, 12 Jan. 2021, https://www.finder.com/uk/cfd-trading-statistics.

- com. “66% Of Investors Regret Impulsive or Emotional Investing Decisions, While 32% Admit Trading While Drunk.” https://www.prnewswire.com/news-releases/66-of-investors-regret-impulsive-or-emotional-investing-decisions-while-32-admit-trading-while-drunk-301351321.html.